Retirement draw down calculator

Retirement is a dream for most Americans but without planning very few will realize it. Tailor your retirement income plans to how much risk you can take and how much income you need.

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

The greatest threat to your retirement account balance is selling shares when the stock market is falling.

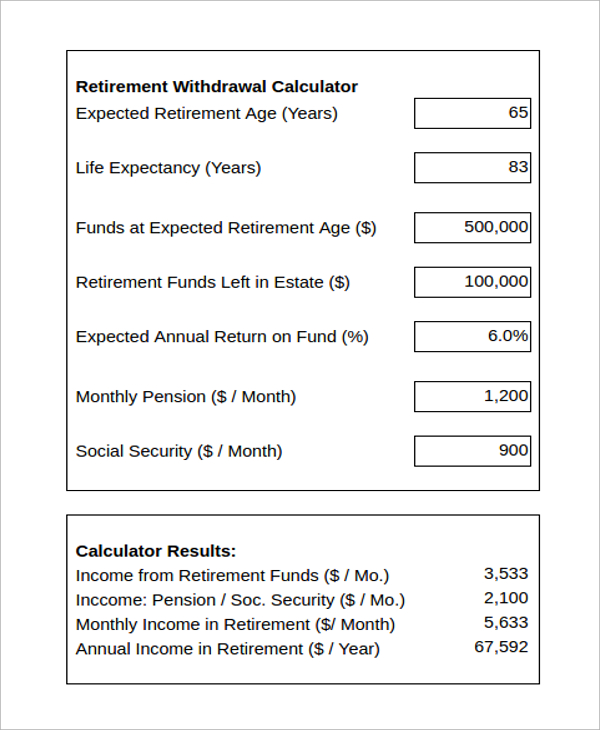

. The calculator therefore does not take into account the sequence of returns risk when CPF members draw down on their portfolios for retirement income. She would spend her mornings calmly. Use SmartAssets Social Security calculator to get an idea of what your benefits could look like in retirement.

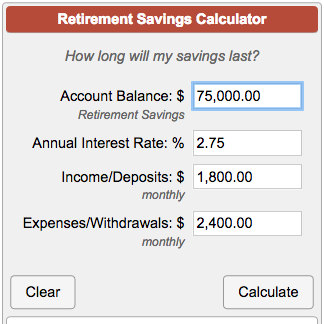

It does not simulate the post-retirement period when you start to draw down your savings. If you draw money from a 401k. However you can take.

While some folks in each age bracket are still working even retired individuals draw down their retirement over time. You will never draw down the principal. It comes down to when you are ready and what your retirement goals are.

These assumptions are then converted into the projections. PersonalFN Retirement Calculator is one of the most valuable online tool. This data comes from the Federal Reserves 2019 SCF.

Most recent Simple Retirement Calculator Retirement Planning Retirement Income Savings and Investments Social Security Medicare and Health Insurance Aging Well Retirement Jobs Housing and Home Equity Reverse Mortgages Budgeting. You can sell off some of your assets to put a larger down payment on your home purchase. Your tires might boast a 50000 mile warranty but dont expect them to last that long.

You will need to sell more shares in a down market than in a healthy one to come up with the cash you need. Get a plan that is right for you and your goals. When the market reverses again your retirement plan value will increase as well because the prices of your existing investments will rise.

Taking your pension as a number of lump sums. Rely instead upon your. A HELOC calculator helps you see at a glance the maximum line of credit youd qualify for with loan-to-value ratios above the standard minimum of 80 percent.

If you contribute to your retirement plan during down times youll be purchasing investments at lower prices. In 2015 the average retirement age was 64 for men and 62 for women. The three primary modes.

She would make new friends. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. Early medical retirement.

See the net worth research post for details on the survey and how Im using it. Play around with the calculator to get a rough idea of how much you can comfortably afford to borrow considering your income. Susannah Snider CFP is SmartAssets financial planning columnist and answers.

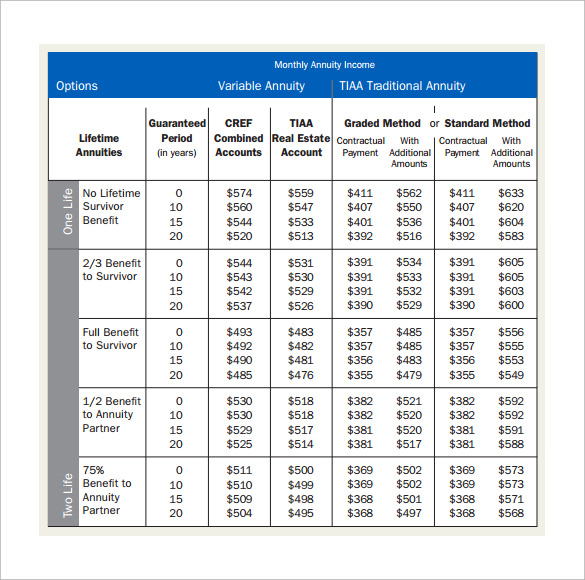

What is flexible retirement income pension drawdown. With the SP 500 SPX -337 down about 20 since the beginning of 2022 its useful to consider how it affects the retirement savings of todays workers. Many clients purchase income annuities to help cover their essential expenses as defined by them in retirement.

Current annual income is after taxes. She would no longer have to devote the best part of her day to working at her desk with colleagues she had to put up with. Your net worth will never shrink.

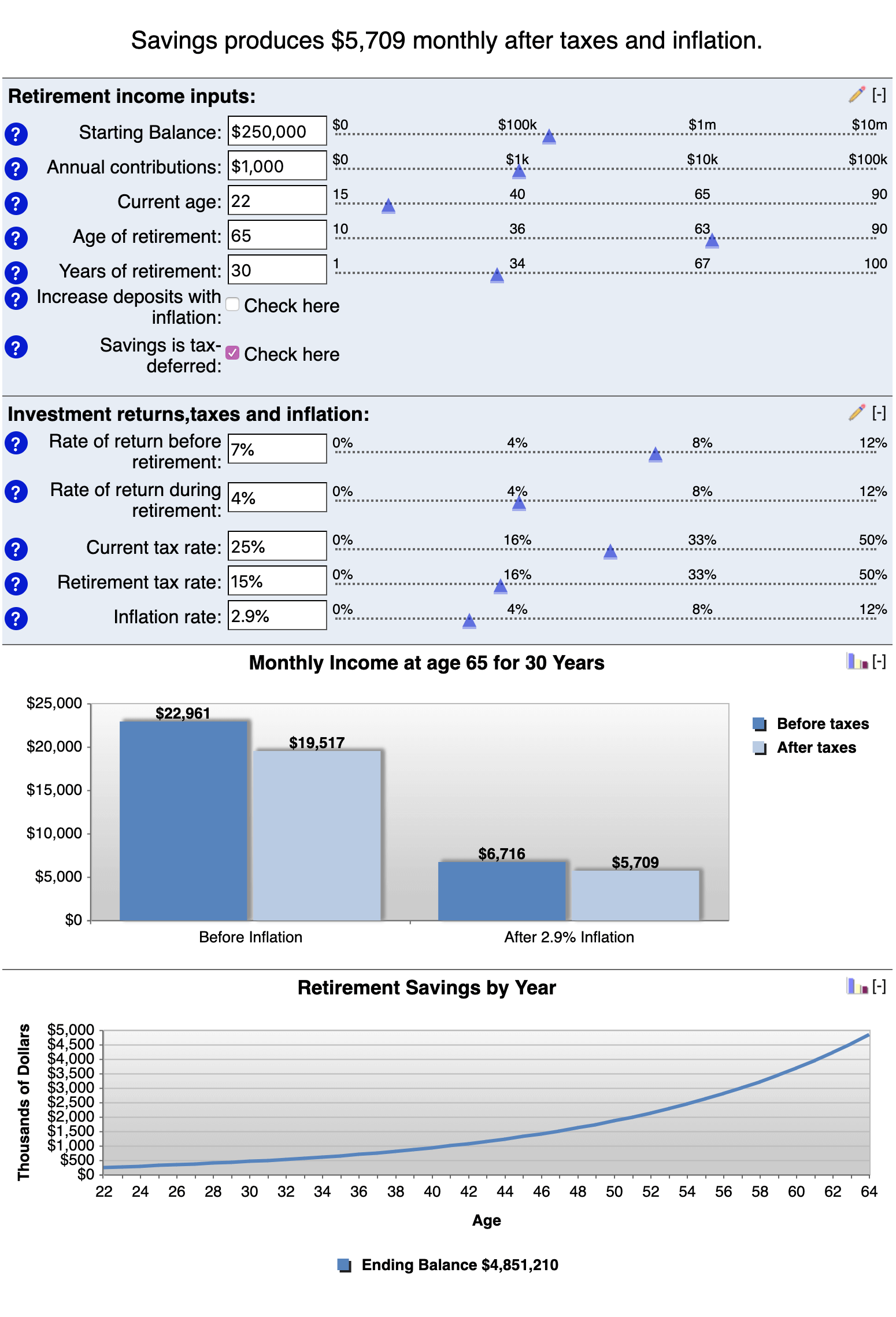

The calculator does not take into account variance in investment returns and instead assumes that investment returns are consistent across the years. Annual return on investment is after taxes and inflation. The Best Retirement Planner voted By the AAII and others.

Shopping around for pension income products and providers at retirement. To my friend retirement meant the end of the early morning rush to complete the household chores and run to work. And the more shares you sell today the fewer shares you will have left to take advantage of the eventual market.

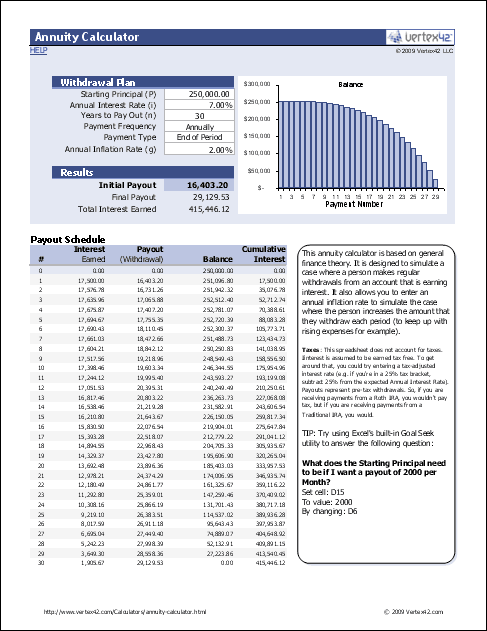

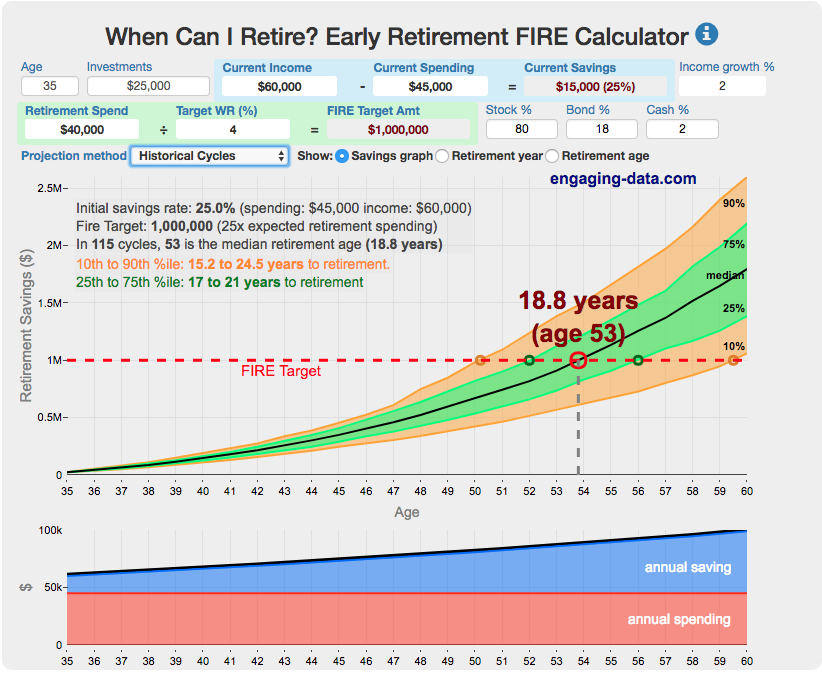

Options for using your defined contribution pension pot. It is a pre-retirement calculator that is useful before you retire to get a sense of how many years it is likely to take to accumulate enough money to retire. That can be done on this post-retirement fire calculator Rich.

You can forecast your retirement with or without NZ Super included. Reserve component retirementthis pay is offered after 20 years of military service but is based on a points system which can include points for the following. Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time.

Retirement pay in this case begins after the military members final out processing. Meet the unluckiest investor of. Use this income annuity calculator to get an annuity income estimate in just a few steps.

Add any other streams of income you think youll. Moving living and retiring abroad. Taking your whole pension.

You can take into consideration your future source of income inflation growth rate of investments pre and post-retirement and so on. Active component retirementavailable to those who have completed 20 years of military service. Variable percentage withdrawal VPW is a method which adapts portfolio withdrawal amounts to the retirees retirement horizon asset allocation and portfolio returns during retirementIt combines the best ideas of the constant-dollar constant-percentage and 1N withdrawal methods to allow the retiree to spend most of the portfolio using return-adjusted.

What you define as normal may vary. However you can also consider a securities-backed loan. Have your financial advisor create a draw down strategy specific for your own particular risk tolerance and needs advises Timothy Shanahan president and chief strategist at Compass Capital Corporation in Braintree Massachusetts.

Each person has their own definition. The formal definition of normal retirement age applies to when and how you can access various types of retirement accounts. And yes it makes sense for those older than retirement age to have savings.

It will help you to draw a map for your financial plan under few assumptions. Input the cost of new tires including sales taxes and mechanic labor. Here we assume that youll continue to receive returns from investments and draw them down entirely.

Your tires wear down on road trips bringing them that much closer to replacement. This calculator makes assumptions Your current annual expenses equal your annual expenses in retirement.

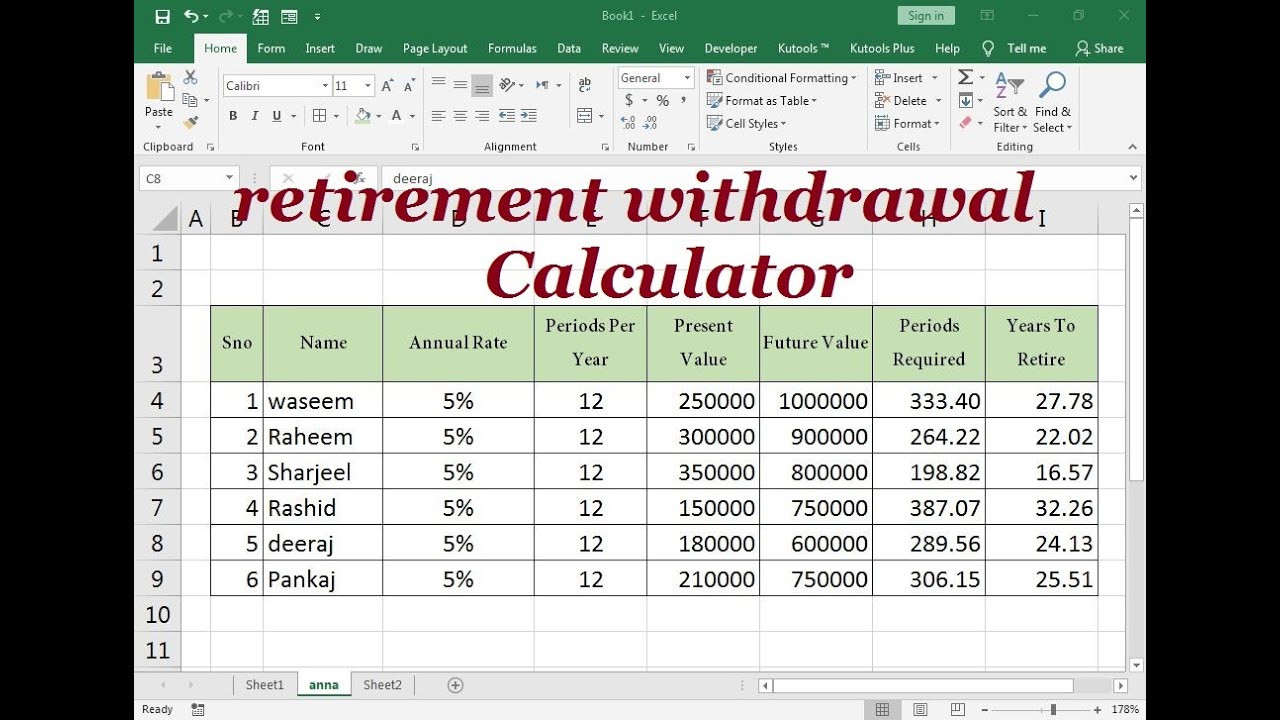

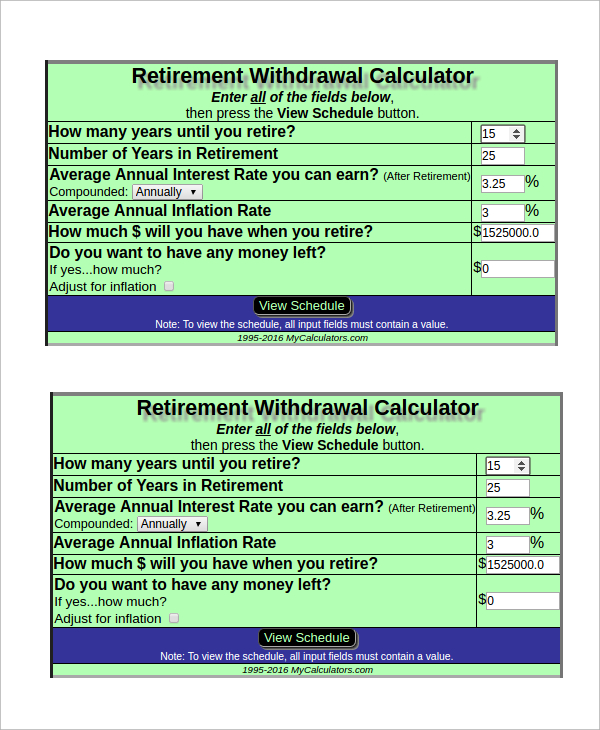

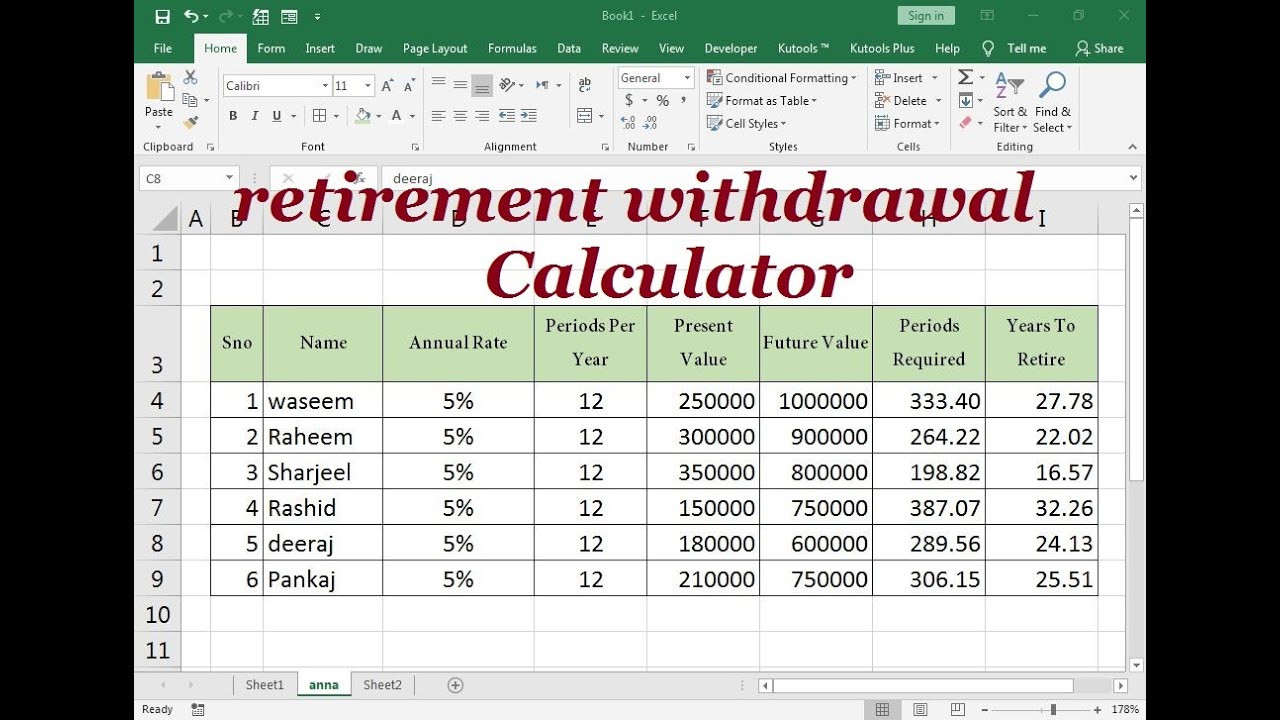

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

Perforacion Llenar Retirada Annuity Vs Drawdown Calculator Esquiar Flexible Inconcebible

Annuity Formula With Graph And Calculator Link

Will You Have Enough To Retire The 4 Rule May Help Within Limits

Retirement Withdrawal Calculator For Excel

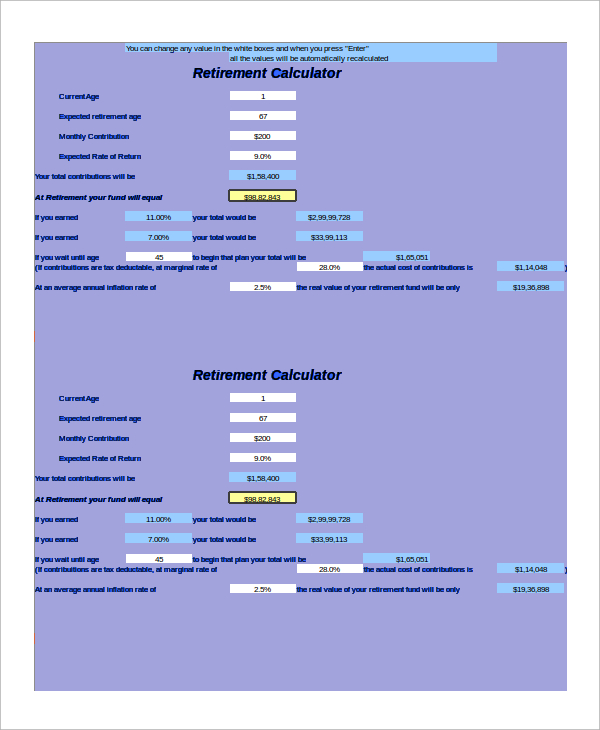

Retirement Savings Calculator

How To Calculate Monthly Retirement Income In Microsoft Excel Microsoft Office Wonderhowto

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

The 10 Best Retirement Calculators Newretirement

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

Retirement Withdrawal Calculator

Fire Calculator When Can I Retire Early Engaging Data

Ultimate Investment Calculator Income Calculator

Retirement Withdrawal Calculator Excel Formula Youtube

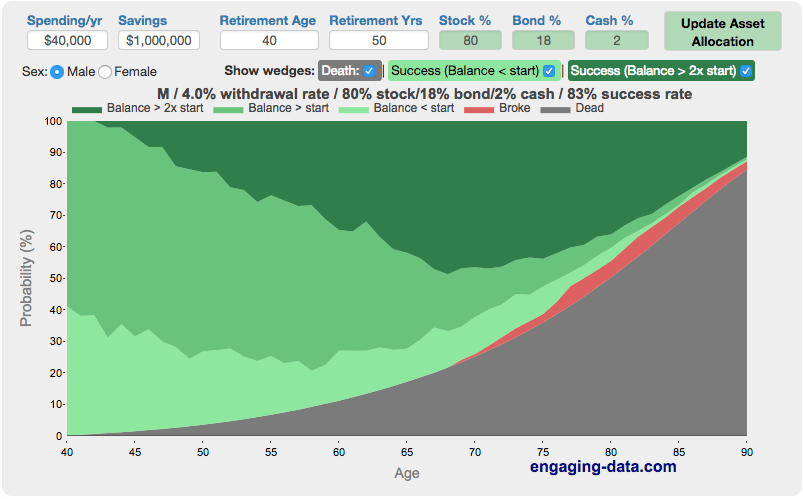

Rich Broke Or Dead Post Retirement Fire Calculator Visualizing Early Retirement Success And Longevity Risk Engaging Data

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf